Listen now

In an era characterized by reduced venture capital investments across various sectors, the European industrial tech scene has not remained untouched by the investment deceleration since Q1-2022. A key aspect affecting the absolute growth rates is the reduced amount of late-stage mega-rounds, but this conceals a more complex story that reveals pockets of resilience within the industry. We will explore the areas that are resisting the trend and indicating promising potential for the future, as well as the European cities where a lot of the innovation in industrial tech is happening.

New market reality impacts investment across all industries

Rising interest rates, geopolitical volatility, weakening valuations, and an IPO drought star among the reasons for slower growth in VC investment globally and across Europe. Based on Pitchbook, the European VC deal value is expected to reach $51B in 2023, which is a steep cut from the whopping $104B invested in 2023 and $109B in the year before that, but still well above previous years’ levels.

Undoubtedly, the impact of declining investments has reverberated across numerous industries, fostering an environment of uncertainty. However, the unstoppable wave of innovation will continue disrupting every industry and multiple sub-domains will keep attracting investments.

This is not different for the European industrial tech sector, which is one of the most well-funded in Europe. In 2022, the sector attracted $5.7B in VC money, 3.6 times the 2018 record of $1.6B. The sector is at the forefront of digital transformation, harnessing technologies like AI, computer vision, and next generation IoT to accelerate the convergence of the physical and virtual worlds.

The European industrial tech scene drill-down

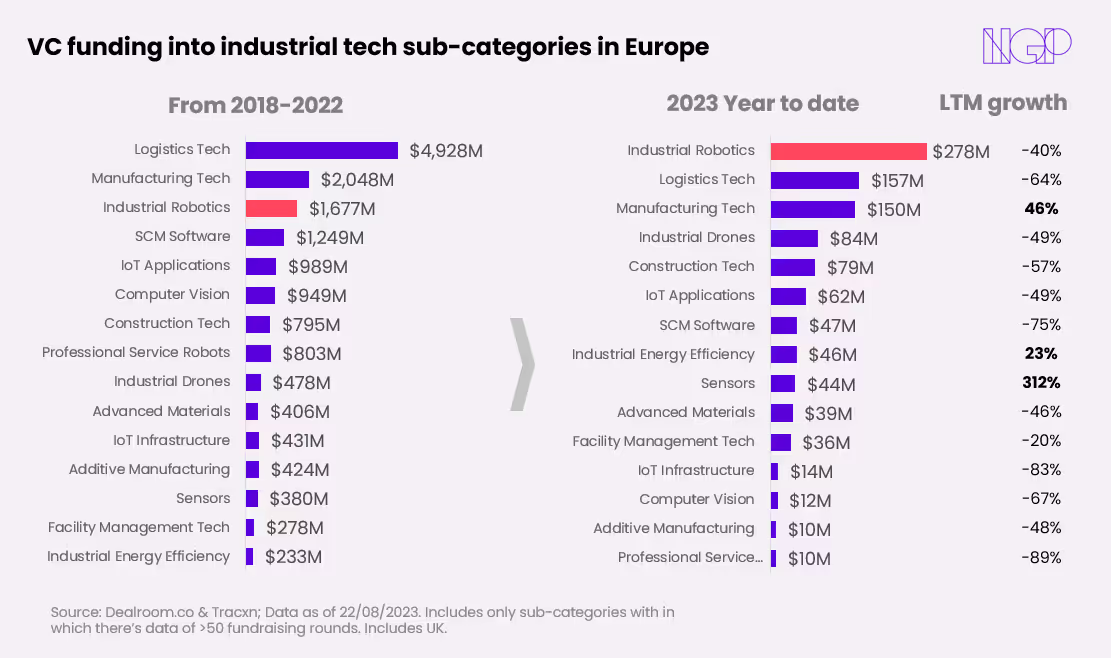

Logistics, manufacturing, industrial robotics, supply chain management, and IoT VC-backed companies have historically been the most capitalized within industrial tech in Europe. In 2023, industrial robotics is leading the pack, with $278M invested into the category by August 2023.

Drones now also integrate the top 5 and are becoming increasingly attractive for the enterprise market. Thanks to advancements in AI, but also the maturity of the segment, costs per flight have decreased, combined with easier setup and improved autonomy stack. This has unlocked several use cases in asset monitoring and defense, as well as logistics and delivery and inventory management.

Despite a broader scenario of scarcer funding rounds, some categories have seen VC funding grow in the last twelve months. Manufacturing tech (+46% YoY), industrial energy efficiency (+23% YoY), and sensor technologies (+312% YoY) are the only sub-categories that saw a surge in VC appetite in the last twelve months, compared to the same period the year before. Although VC funding may not be growing year over year in all industrial tech sub-categories, these areas play a critical role in achieving improved operational efficiency, data-driven decision-making, cost reduction, and pressing industry needs like reaching sustainability goals. These companies are solving problems with tangible benefits and these requirements won’t go away despite the macro environment.

Another key aspect affecting the absolute growth rates in the last twelve months is the reduced amount of late-stage mega-rounds (Series B+). For example, while Industrial Robotics VC funding is down 40% LTM, the funding into early-stage companies (Pre-seed, Seed, and Series A rounds) is up 170% YoY. If we delve into the evolution of industrial robotics investments in Europe, we observe a 27% CAGR from 2018 to 2023. Based on this, 2023 is on track to become the third-largest investment year after the record-breaking 2021 and 2022.

Industrial robotics' hubs in Europe

The global market size of industrial robotics is expected to reach $117B by 2030 with a CAGR of 11.7%. This massive growth trend can also be spotted in the number of companies founded and the investment pace of the space in the previous years.

The accelerated influx of capital is not accidental. On one hand, a rising need for productivity, cost-efficient operations, and a growing shortage of skilled labor in manufacturing industries are pressuring companies to adopt automation at a faster pace. On the other hand, advances in AI, such as deep learning, computer vision, and the development of self-programming and no-code robots are enabling a new generation of robots. They incorporate human characteristics such as intelligence, flexibility, memory, learning ability, and object recognition and are suited for fast-moving and complex industrial environments. We believe these developments set the foundation for exponential future growth and you can dive deeper into our thesis on the new wave of robotics here.

Looking ahead

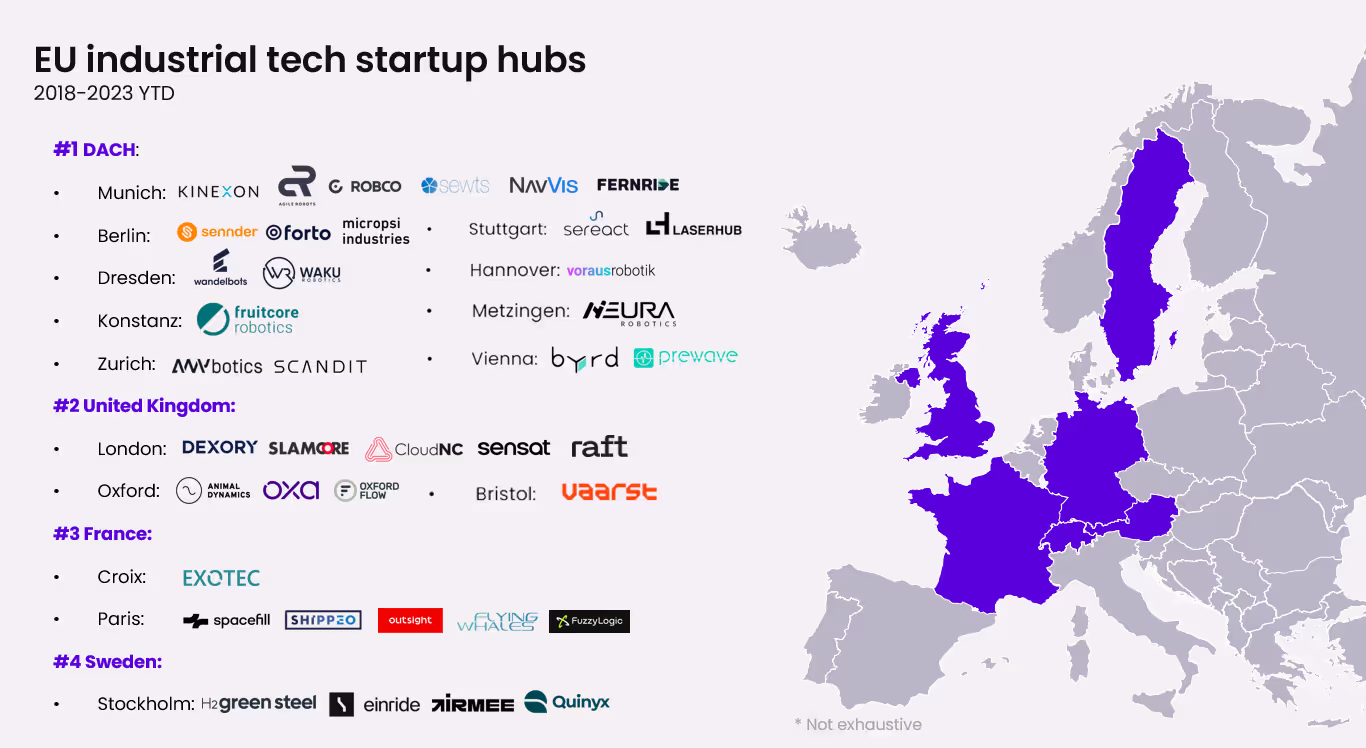

Europe stands as a hotbed of innovation in the industrial tech sector with hubs across the continent. There are a multitude of exciting startups emerging in Europe every day and setting their foundations for future growth despite any investment slowdown. Let’s explore the key regions where a lot of the innovation is happening.

1. DACH Region - Cities like Munich, Berlin, and Zurich serve as thriving tech hubs for startups specializing in fields ranging from robotics to supply chain optimization. Unsurprisingly, Germany is the country with the highest concentration of industrial tech companies in Europe as it accounts for 26% of EU’s value of sold industrial production. Although Munich attracted more than 50% of total VC funding invested in the region since 2018, Germany has a very well-distributed pool of startups emerging in many cities around the country. In Switzerland's, robotics excellence is rooted in institutions like ETH Zurich and EPFL. Nonetheless, the country’s commitment to R&D and collaborations between universities and large corporations drive practical applications across different areas, exemplified by our portfolio companies Scandit and ANYbotics.

2. United Kingdom – Europe’s top startup hub couldn’t stay out of the list. UK’s thriving entrepreneurial ecosystem, access to venture capital, diverse talent pool, and supportive government initiatives such as the GBP 4.7B Industrial Strategy Challenge Fund make the UK one of the top growing industrial tech and industrial robotics hubs in the continent. Capital is then distributed at large scale into several areas, spamming autonomous driving, robotics, digital twin, manufacturing tech, and supply chain management.

3. France – France is emerging as a strong player in industrial tech, specifically in cities like Paris and Croix. While Croix is home to the unicorn Exotec which raised most of the robotics VC funding so far, most of the emerging industrial tech startups are concentrated in Paris, the country’s tech hub. Our Parisian portfolio startups Shippeo, the leader in global real-time transportation visibility, and Spacefill, that enables flexible connected warehousing, are good examples of the thriving ecosystem.

4. Sweden – Stockholm, Sweden's industrial tech center, uniquely combines a robust educational system with a strong national focus on sustainability and digitalization. The city is home to unicorns H2 Green Steel and Einride which are pioneering eco-friendly solutions in steel production and autonomous freight. Sweden's commitment to environmental sustainability makes it an attractive hub for startups aiming to revolutionize industries in a sustainable manner.

Looking ahead, founders will encounter a maturing ecosystem of customers whose strategic priority increasingly points towards automation, unlocking a generational opportunity.

At NGP Capital, we have been closely following the industrial technology market since2014. Our investments include Digital Lumens (exited), Sensoro, Next, Shippeo, SVT Robotics, ANYbotics, Scandit, Spacefill, etc. We remain excited about the new wave of iconic companies emerging to tackle this huge market opportunity – get in touch if you are building in this space or passionate about this topic as we are!

.svg)

.svg)