Decoding the VC Code: How investor reputation affects startup fate

Listen now

In the world of venture capital (VC), an investor's reputation is a priceless asset. However, its significance and impact are difficult to define, as reputation is built over time and is based on a variety of observable and non-observable factors.

Factors such as investment and exit activity, visibility in the media, relationship with other investors, and the perception of founders and limited partners (LPs) all play a crucial part in shaping a VC’s reputation. Undoubtedly, a positive reputation is beneficial as it can give access to superior dealflow, help with fundraising, and strengthen connections to other VCs and stakeholders.

Yet, one burning question remains: What role does an investor's reputation play in the ultimate success of startups at the exit stage?

A new study by NGP Capital delves into this exact question by focusing on the impact of VC‘s reputation on the outcomes of European startups. While the subject has been previously studied from a U.S. perspective, research regarding the relationship between the reputation of European VCs and startups has been scarce.

The study aims to shed light on two primary questions:

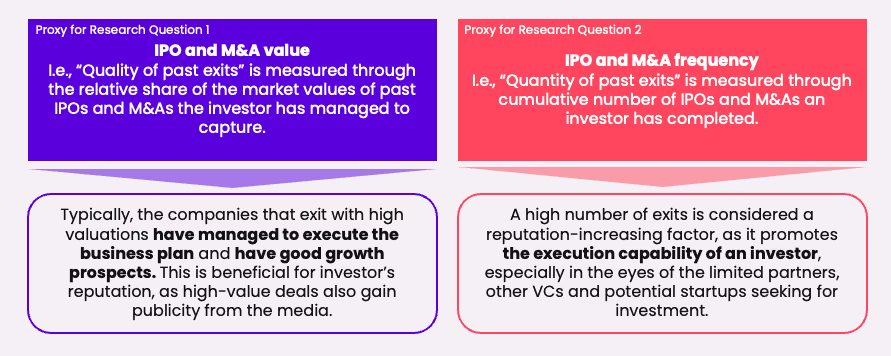

1. Does an investor's reputation, as measured by the value of their past exits, have a positive influence on the outcomes of startups they invest in?

2. Does an investor's reputation, as measured by the frequency of their past exits, positively impact the fate of the startups they support?

Utilizing investor’s past exit track record as a predictor for future success

We investigate 2244 European startups that raised their first VC funding during 2000-2015 and the lead investor(s) of those investments. Most of the data for the study has been retrieved from Q, NGP Capital’s internal data and machine learning platform, which aggregates startup and venture capital data across multiple sources.

We assessed VC reputation through the past exit track record of investors of the sample of startups by forming reputation proxies from the value and frequency of the investors’ Initial Public Offerings (IPOs) and Merger and Acquisition (M&A) exits from the five years preceding the investment into a startup. We then tracked the set of startups until the end of the year 2019 to see if there is an exit via an IPO or M&A and how long it has taken to get to it and assess the impact of the investor’s reputation on the outcome. The method is similar to prior research from the U.S. by Nahata (2008).

Reputation has a positive effect on the outcome of startups

Key findings of the study suggest that the gained reputation of investors positively affects the outcome of the startups they invest in. The analysis of the key questions of the study implies that both the value and frequency of investor’s exits have an impact on the portfolio company’s outcome. However, the reputation proxies formed on the basis of the value of past exits provide more consistent and stronger evidence for the effect, rather than the sheer activity of the past exits, indicating that the quality of exits is a better predictor of future success than the quantity of them.

The positive association between investor reputation and startup success is aligned with past research, but as mentioned, the topic has not been well-covered in the European region. This study highlights the financial implications of VC reputation for the European ecosystem, as it emphasizes the importance for investors to cultivate and uphold a positive reputation by aiming for high-quality exits.

Implications for future studies as Europe’s ecosystem matures

It’s important to note that the study reflects a period in Europe’s VC ecosystem when it was still in its infancy. Subsequently, it may not entirely reflect the present landscape. Given the substantial growth and maturation of the European ecosystem over the past decade, the significance of VC reputation is expected to have increased. The emergence of new VCs and the growth of the number of European startups that successfully achieved high-profile exits have undoubtedly created a flywheel, where successes of the last decade will lead to future triumphs for many European VCs and startups.

.svg)

.svg)