Listen now

In December, Cambridge Mobile Telematics announced a $500 million investment from Softbank to expand its usage-based insurance (UBI) offering. Clearcover, a digital auto insurance broker, announced a $43 million round led by Cox Enterprises in January. They join Root and Metromile, which together have raised nearly $500 million for their UBI programs.

Usage-based insurance promises customized rates reflecting actual individual driving behavior rather than actuarial rates based on broad demographic profiles.

Usage-based insurance promises customized rates reflecting actual individual driving behavior rather than actuarial rates based on broad demographic profiles.

Better drivers pay lower premiums. Riskier drivers receive higher rates. Lower rates have lured new users to this model. Root and Metromile together wrote $56 million in new UBI policies in the third quarter last year, nearly four times higher than the prior year.

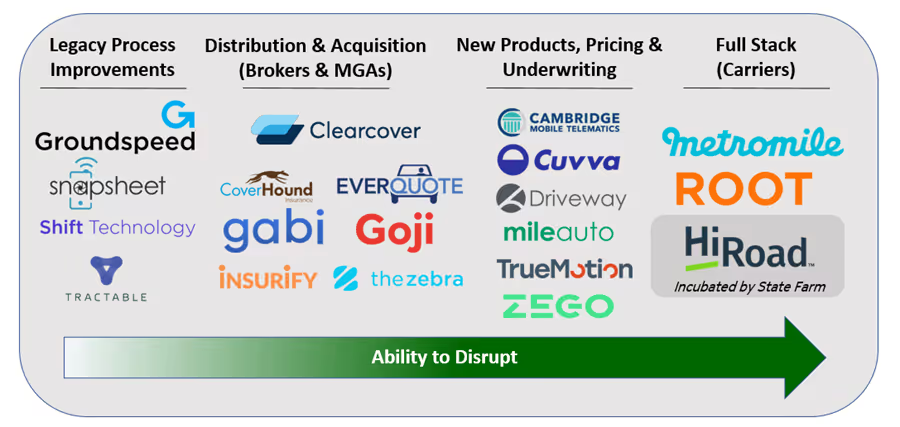

Selected Auto InsurTech Companies

Despite much funding and frothy valuations, UBI is an unproven business. Loss ratios are 30-50% higher for UBI newcomers versus those of traditional insurers, leading analysts to speculate that UBI insurers are buying business by offering lower rates. The breadth of the UBI market is also unclear: UBI may only benefit 10% of drivers, leaving the others in a neutral or disadvantaged position.

UBI may only benefit 10% of drivers leaving the others in a neutral or disadvantaged position.

Yet usage-based insurance is here to stay. Most established insurance carriers have their own UBI programs. Progressive launched its Snapshot UBI program in 2011. Nationwide followed with SmartRide, State Farm with HiRoad, and WR Berkeley with Intrepid. By year end 2017, there were 14 million UBI policies globally, including 4 million in the US.

Usage-based insurance offers benefits beyond better pricing. Encouraging better driving behavior through UBI monitoring has improved driving scores by up to 25%. Discovery Insure in South Africa offers rewards for improved driving behavior.

Encouraging better driving behavior through UBI monitoring has improved driving scores by up to 25%.

Real-time monitoring enables better accident recognition and service. As with the General Motors Onstar system, UBI providers may offer peace of mind for faster roadside assistance. Unipolsai in Italy has introduced tools for claims handlers to more quickly and accurately handle insurance claims by more precisely assigning crash responsibility.

Fleet managers are early adopters of using driver behavior monitoring to encourage good driving and lower accident risk. Monitoring systems such as SmartDrive use inward- and outward-facing cameras as ground truth for driver assessments and crash responsibility. Drivers are increasingly using cameras and sensors for anti-theft protection and crash detection.

While UBI economics are still a work in progress, connectivity with drivers offers many potential benefits that consumers and insurtech firms are only starting to realize. As recent funding suggests, this is a space to watch.

.svg)

.svg)

.avif)