Listen now

The rise of earth observation

It’s no secret that the Space Tech ecosystem has experienced explosive growth over the last 10 years with SpaceX continuing to dominate headlines by their high volume of launches, and Elon’s public mission to make “humans an interplanetary species.” However, the biggest beneficiary of the industry’s growth has been our newfound ability to monitor our terrestrial home, Earth.

Traditionally, VCs have been cautious of backing earth observation (EO) startups given the high capital requirements and launch risks, though the success of launch providers like SpaceX and RocketLab have provided a cost effective and reliable path to orbit and, thus, an astounding rise in investor interest. According to BryceTech’s 2023 report, venture funding in the Space Tech startup ecosystem has ballooned from less than $1B in 2013 and 2014 to greater than $10B in 2021 and $7B in 2022. The first generation of remote sensing satellites from startups like Planet Labs and Spire had a small form factor (CubeSats) and struggled to produce data at a quality that could provide intelligence. However, in the last 5 years, decreasing launch costs have allowed these players to launch larger satellites (SmallSats) with more powerful sensors, which has dramatically increased data quality. Today, they have hundreds of satellites in orbit and are beginning to demonstrate the commercial demand for their data and, more importantly, the viability of their business model (Planet Labs is projecting to be free cash flow positive by 2025).

A decrease in launch costs is just one input into the historic rise of earth observation startups. Other key market drivers include technological advancements in satellite and optical components as well as industry standardization. These breakthroughs have enabled the next generation of satellites to be smaller, lighter, cheaper, and easier to operate. Emerging startups like Loft Orbital and York Space Systems are beginning to reach scale with their vision of democratizing remote sensing even further. By combining modular hardware with standardized software tools, they are creating a platform where a single satellite design can integrate with any earth observation sensor. We also see a compelling market opportunity for newer players like Muon Space and Apex who want to standardize the end-to-end platform, which includes the satellite bus—a piece of the value chain dominated by Airbus and Boeing.

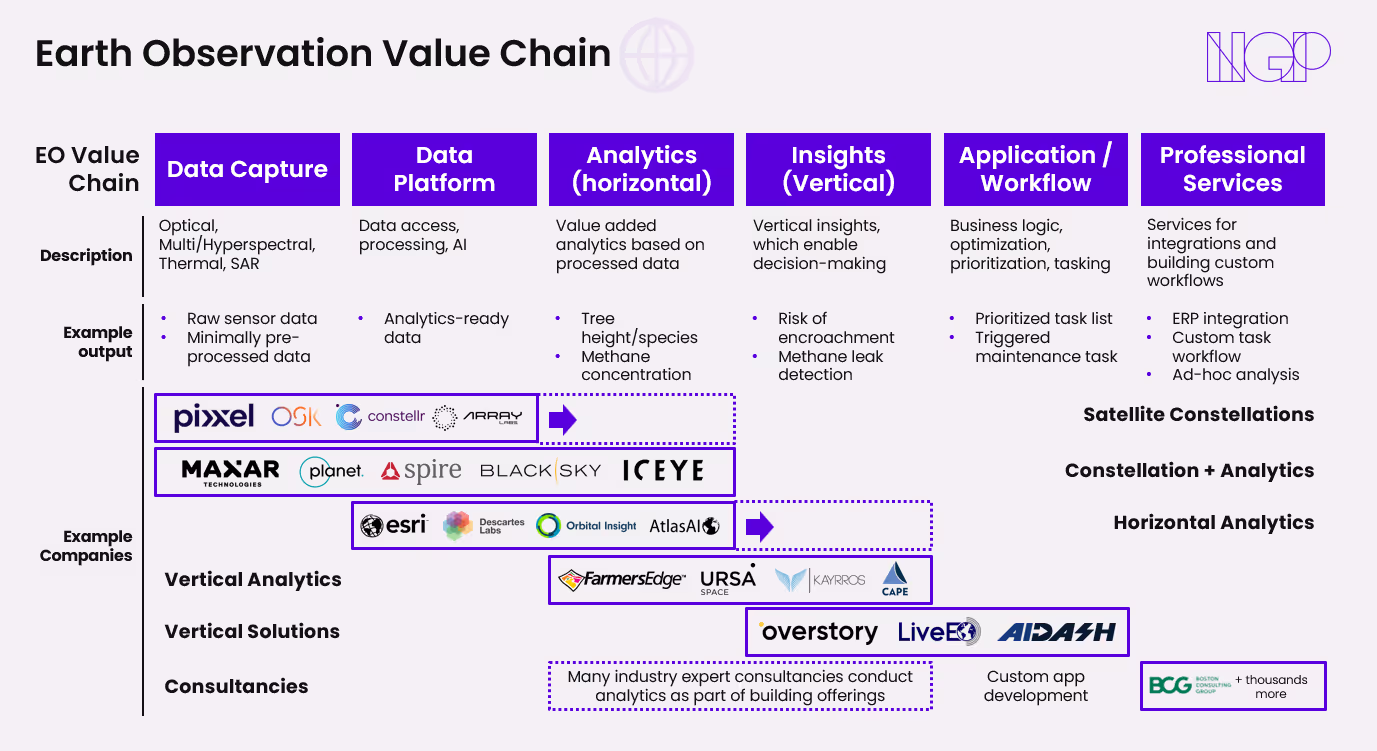

As more of the value chain gets derisked and standardized, the earth observation market has rapidly transformed from a government-dominated sector to an evolving commercial ecosystem. The number of new earth observation satellites launched grew exponentially from 10 in 2013 to over 200 in 2022 with over 1,000 currently in orbit (BryceTech 2023). According to the 2024 EUSPA report, the EO market was valued at $3.7B in 2023 and projected to grow to $6.5B in the next 10 years with value added services expected to make up greater than 80% of global revenues in 2033. With the number of remote sensing satellites currently in orbit reaching scale coupled with the emergence of high-quality sensor data across a wide range of sensing technologies (SAR, Optical, Radar, Infrared, Multispectral), the challenge moves from data capture to data processing.

The role of AI in EO

The integration of AI across geospatial data sources and remote sensing technologies is key to unlocking enterprise value with earth observation market. In the last 5 years, the volume of annotated geospatial data and the increase in multi-modal model performance has already begun to solve high-value commercial use cases that were previously unimaginable. According to GP Bullhound’s 2024 report, Planet Labs demonstrated they could use current AI technologies to identifying tree height and type from images representing 13 trillion pixels in less than 2 minutes—a task estimated to take a human analyst 7 years. Additionally, emerging vertical geospatial intelligence startups such as LiveEO, AiDash, and Kayrros are combining unique geospatial datasets, deep learning models, and high-performance compute architecture to unlock value across a wide range of industrial use cases. The market is still nascent with newer entrants building end-to-end platforms to solve enterprise challenges across environmental epidemiology, infrastructure and asset monitoring, vegetation management, and carbon monitoring, to name a few. The accuracy of geospatial models brought to market as of late has demonstrated the potential for providing high-value insights at scale for industries that have traditionally taken an analog approach.

Key market drivers for geospatial intelligence

1. The cost of geospatial data is decreasing while data quality and volume is increasing

Decreasing launch costs (10x decrease in the last decade) along with technical advances in optics have continued to drive down the cost versus performance curve of satellite imagery. Due to cost constraints, the first generation of remote sensing satellites were smaller (CubeSats), but the next generation is choosing a larger form factor (SmallSats) with higher data quality. This phenomenon coupled with the increasing supply of geospatial data from large data providers like Maxar and Planet reaching scale has continued to drive down data costs.

2. The rise of new sensing technologies is unlocking key enterprise use cases

The first remote sensing technologies to reach scale were optical, RF, and SAR with incumbents like Maxar, Planet Labs, ICEYE, and Spire. However, new sensing technologies are emerging including hyperspectral, thermal, and LiDAR that unlock use cases from methane gas detection to seasonal drought patterns.

3. The cost and complexity of building AI applications is decreasing while model performance is increasing

Technical advancements in GPU performance and model architectures have democratized access to highly performant multi-modal models and lowered compute costs. Further, the maturity of AI development platforms has simplified AI pipeline building and lowered the burden of human annotation—allowing companies to unlock intelligence from large geospatial data sets.

4. Increasing regulatory environment and enterprise awareness around climate change and sustainability

Executive teams across industries and geographies are looking for new technologies to meet increasing regulatory requirements and ESG initiatives. Many of these use cases including carbon monitoring, biodiversity monitoring, climate risk analysis, and water & waste can only be unlocked at scale using geospatial data sources.

5. Increasing data standardization and market education

Emerging geospatial analytics providers are actively building marketplaces to standardize geospatial data formats. Additionally, as the number of enterprises and data science teams that are familiar with geospatial data continues to grow, less market education is needed for value creation.

How startups can build a sustainable business in the EO value chain

At NGP, we believe geospatial intelligence is core to our investment thesis of the great convergence between the digital and physical world. Advancements in data collection and AI model performance can overcome the challenges of classifying, detecting, and segmenting large volumes of data and, thus, unlock downstream intelligence. In 2030, we see companies leveraging geospatial data as readily as the common data sources used today (text, image, and video). That being said, emerging startups should think about the following while scaling their business.

1. End-to-End Intelligence Platforms

Geospatial data is costly, difficult to work with, and needs to be integrated into the daily workflows of enterprises. Most industrial companies and potential early adopters do not have the required expertise to make use of this new data source at scale by building and training AI models on geospatial data sets. Startups in the intelligence layer who offer end-to-end platforms and abstract out the challenge customers face when working with geospatial data will become market leaders. This approach reduces dependency on an evolving ecosystem, sets a strong foundation of trust for future product expansion, and lowers the need for market education.

2. Build for the End Customer

A steadfast commitment to developing solutions for specific customer needs is vital from day one. The first generation of earth observation startups suffered from developing advanced space technology without a clear understanding of the highest value use cases. Thus, instead of building technology and hoping the applications will emerge, founders should start with deeply understanding their end customer and stay committed to keeping these stakeholders involved during the development process.

3. Build vs. Buy Strategy

Early movers in the earth observation ecosystem were forced to build and manufacture most of their satellite platform in-house. This created high capital requirements and significantly increased the time to first revenues. However, as the Space Tech ecosystem has matured and standardization has emerged (satellite buses, optical components, satellite operations software, etc.), startups should think critically about their key value driver. Whether it’s the sensor, the satellite platform, or the downstream intelligence layer, this design decision will be critical for developing a viable business model and finding the most effective partners.

4. Composable Data Acquisition Strategy

As the number of satellite operators continues to grow and the quality and cost of data changes across providers, startups that leverage this data should avoid vendor lock-in. By building a composable data acquisition pipeline and developing key partnerships when necessary, companies can maintain strong unit economics and avoid supply-side risk.

5. Economies of Scale

In this capital-intensive sector, startups who achieve economies of scale will have a significant first mover advantage, though founders should be mindful of their long-term monetization strategy. As competition increases with more startups launching satellites into orbit, the cost of data will decrease while the quality increases. Founders should have a view on how their business model and go-to-market strategy will adapt over time. The product roadmap should include features that will continue to drive differentiation and long-term value.

Conclusion

At NGP Capital, we recognize the transformative impact of the convergence between AI and geospatial data. We are excited to speak with founders who believe that this combination will unlock opportunities across vertical industries and sustainability. We believe the newfound quality and accessibility of this data source represents a unique opportunity for disruptive innovation, where the possibility of backing teams that reach $10 billion outcomes is not just a dream but a tangible reality.

Connect with me on LinkedIn or via email at eric@ngpcap.com to explore this exciting frontier further. Let's discuss how geospatial data and AI can shape our planet's future.

.svg)

.svg)